The music business and the technology sector are similar.

Elitism, and indoctrination, aside.. there are very real similarities between the way venture capital, Silicon Valley, and the music business operate.

This article is strictly from the perspective of someone who has been a commercial attorney in the music business and for software / tech companies. I’m writing this, in part, to clarify my own thinking; but perhaps it will help someone else as well. Maybe it will also help shed light on alternative career choices for those who don’t feel like a career in tech is right for them.

We all know the diversity rates in tech are abysmal.. no stats needed.

In Part II, I’ll provide my notes on Venture Deals - a book written by two prominent founders and investors - to show the similarities from the POV of expert investors.

Anyway, here we go.. after ten years of legal experience in music and tech; here’s a high-level overview of the similarities between music and tech.

Artists = Founders

Labels = Venture Capitalists

Producers + Songwriters = Software Engineers + Product Designers

Accountants and Lawyers are the same..

“Let up the suicide doors, this is my life homie, you decide yours”

Kanye, Can’t Tell Me Nothing

Let’s start with founders aka artists.

Founders are very protective of their work, their art, and their companies. A software company, and a burgeoning music career, are the culmination of several years of blood, sweat, and tears. This means that it’s personal for the founder; and right, or wrong, they want to do it their way - even if it doesn’t always make the most business sense.

I ran a music law practice for about 5 years and I did it my way. It wasn’t always the most profitable, efficient, or organized way but it was run the way I wanted to run it. I eventually shut it down and went in-house full time after burning out from working 60 - 70 hour weeks for a few years straight. The point is - founders don’t always want to do the most profitable thing, they want to do what they want to do.

When it comes to the music industry, this mindset often leads to conflict with record labels when the label wants the artist to do something the artist doesn’t want to do.

Can the artist x label relationship be cringy sometimes?

for suure.. a lot of times.

And even though most artists simply sign because of money, mental programming, and the fact that label's have network effects (not unknowable, mysterious, secret powers); the reality is that the label has access to market data that artists don’t always have. Labels see what’s working in the market and they push the artists to copy what works.

Think back to the 90’s and early 2000’s (if you’re old enough), how many Britney Spears clones did you see? I won’t call anyone out, but it’s public knowledge that many singers of that era were pressured into copying the “Britney” model. You see the same thing in tech, and the startups venture capitalists choose to fund.

“Life is pretty simple: You do some stuff. Most fails. Some works. You do more of what works. If it works big, others quickly copy it. Then you do something else. The trick is the doing something else.” (Leonardo Da Vinci)

The problem with this is - real artists (and founders, I’ll be using those terms interchangeably) don’t want to copy others.. They don’t want to do things that could work big but conflict with their vision.

I know an artist who, right now, could make an afrobeats song that sounds just as good as the songs made by Burna Boy, Wiz Kid, Asake, Fireboy Dml; etc. (top afrobeats artists). He has the look, personality, charisma, and stage presence.. the whole 9 yards. The problem? He doesn’t want to make afrobeats, at least not the commercial version.

You know.. the kind that would easily sell.

In his mind, that would be too easy. He would feel like he was cheating himself. So he’s pushing himself to do something different.

I get it. I’m the same way, there’s a lot of things I could do. There are things I could sell. There are networking groups I could join, and conferences where I could speak.. but that’s not me.. I’m chasing something else.

The issue is - artists, and founders, have to balance their artistic integrity with commercial appeal. Music, like tech or any other field, is a business. If you want to do it as a hobby, that’s cool.. be as weird as you want to be.. freak out.

But if you want to make money from your craft.. your skill.. and your gifts.. then there’s a balancing act to be done.

It’s been my experience that, often, the artists who aren’t the most naturally gifted are the ones who often do the most studying on the business; while the most naturally gifted artists are often the most business illiterate.. actually, let me use the word uninterested.

It’s not that they can’t understand business and the financial implications of their career decisions. It’s that they aren’t interested in doing so. The creative aspect is the most important thing to them. It’s why Michael Jackson and Kanye West could spend millions of dollars on their albums and tours and go into the red. It’s because they care about their vision above all. You see the same thing with tech founders and their businesses. Many have an idea so seared into their brains that trying to get them to change for the sake of profit, in any way, is often like trying to open the mouth of a crocodile.

Vice grip.

But balancing artistic integrity with profitability doesn’t mean you have to sell your soul. It means you have to know how to present it in a way that not only maintains your artistic integrity, but is also packaged in a marketable way. Most people like simple things.. so you have to meet them where they are.. if you want to make money, that is.

The record label execs weren’t 100% wrong when they told Lupe to “dumb it down”.

You should dumb it down; but only for the sake of lifting up.

Put the medicine in the candy… even Jesus used simple stories to communicate deep truths.. and no one is deeper than Jesus.

The point is.. it doesn’t matter who you are, people won’t listen (nor buy from you) if you make them feel stupid or confused. And most people just want their lives to be better and more comfortable.

People want to have fun and live life.. so don’t kill the vibes.

Before you try to create a new genre, master the old one.

Go back and listen to Michael Jackson records.. almost every album he dropped was in line with the music trends of the time.. and those that weren’t didn’t do too well. ‘Off the Wall’ is a disco album, ‘Billie Jean’ is a funk record mixed with r&b, pop, and disco with synth sounds sprinkled on top. ‘Remember the Times’ is a, Teddy Riley produced, new jack swing record.

There’s nothing new under the sun.

There were plenty of artists making songs that were similar, and just as good as the songs Michael made; but Michael was more commercial than many artists. He knew how to ride the wave of cultural trends and combine different elements, putting his own spin on them. Even many of his moves were moves that had been performed by artists of the past, like James Brown.. and I’m sorry to break it to you, but Michael Jackson didn’t invent the moonwalk.

That said, Michael’s genius was in taking the old and making it new.

We’re all repackaging old ideas in new wrappers and so the task of every artist or founder is to understand history, current cultural trends, and find the perfect wave to ride into the future. Artists have to ask themselves whether they want to: (a) be super artsy and fringe, but not make any money; (b) be super commercial / corporate and make a lot of money but sell out on their vision and creative ideals; or (c) find a way to get their message across while making money.

It’s easy to be “smart” and “hyper creative” but not make any money. It’s harder to consistently make money from your intelligence and creativity because then you have to actually deal with people, personalities, and differing perspectives. It’s the hardest to consistently do all of that while being your authentic self.

From a high level, those are the types of decisions founders and artists have to make. Committing to a vision, while generating investor interest, while timing the market, while being profitable is a Herculean feat; one that many can’t accomplish.

We saw this clearly in 2022. As The Wall Street Journal stated, in 2022, “U.S.-based venture-backed startups laid off more than 35,000 workers, according to Layoffs.fyi, a website that tracks job cuts in the technology industry. Some have scrapped business plans or shelved new products.”

The article also states “roughly 2,750 startups in 2021 raised a seed round—generally the first round of institutional funding for a startup—and haven’t raised any venture capital since, according to an analysis of PitchBook data. Many of these startups, mostly young and unprofitable, risk running out of money in the coming year.”

Nonetheless, innovation and economic progress demand visionary founders who can weather the storm. When we read about the journeys of entrepreneurs like Jeff Bezos (Amazon), Howard Schultz (Starbucks), Ray Kroc (McDonald’s), Steve Jobs (Apple / Pixar); and many others.. one common thread is that they all had long-term vision. They all saw beyond the present day circumstances and apparent limitations.

That’s the mark of a founder, and an artist.

However, it often conflicts with the incentives of investors.. particularly those who are primarily concerned with their return on investment.

We’ll talk more about this in Part II; but whether we’re talking about the music business, venture capital deals, or software companies - every founder, who truly cares about the vision of their company, has to carefully weigh the commercial interests against their own long term goals.

“I got the power to make your life so exciting”

Kanye, Power

Let’s talk about record labels and venture capitalists.

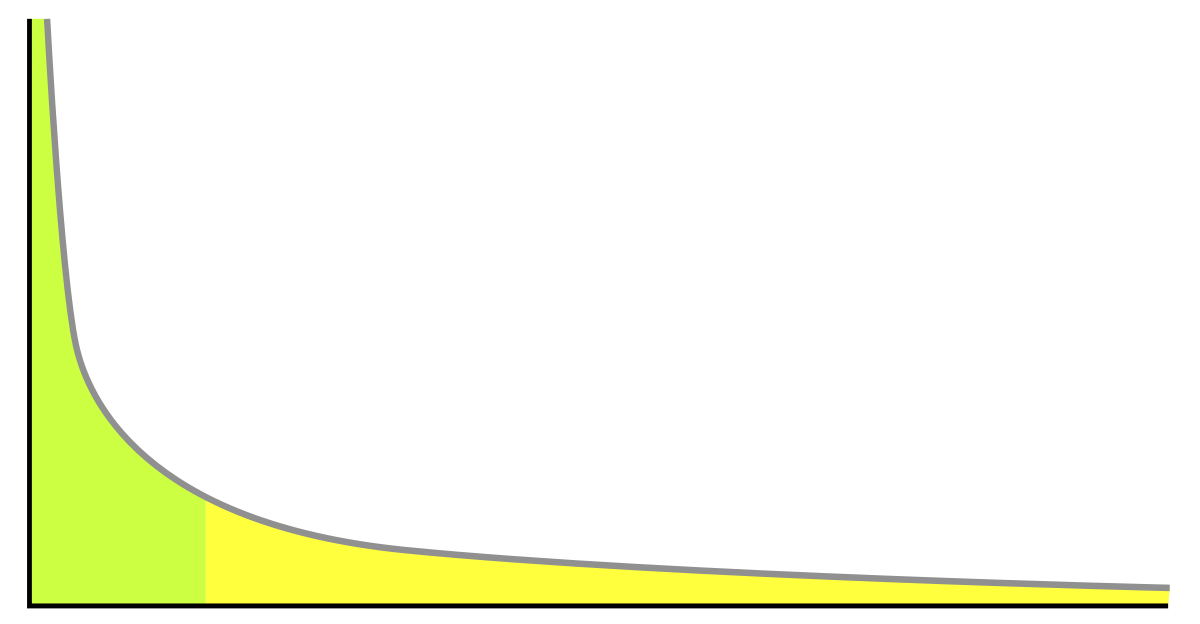

I recently read a great article by a VC, Chris Neumann, about the 9 types of venture capitalists. I recommend you check it out. One of the 9 types Chris mentions, is a Power Law VC.

To quote Chris,

“Power Law VCs” are VCs whose investment thesis is strictly based on an assumption that returns in venture follow a power law distribution. These investors expect one or two companies to drive the returns of their fund, while the rest will provide a rounding error. . . it’s important that you be clear about what type of company you want to build before accepting capital from a power law VC.”

What’s a power law distribution? In a nutshell it says that big outcomes are less likely; while small outcomes are more likely.

You see this same dynamic in the music business. For example, in the music business, it’s been estimated that roughly 1% of artists generate 90% of streams.. that’s the definition of a power law distribution.

That creates all sorts of measurable, and immeasurable, ramifications in the music business. I wrote about some of it in my article entitled: Navigating Music Industry Landmines: Power Dynamics in the Music Business.

Here’s another example.. the expectation, on average, is that if a record label signs 10 artists, 5 won’t “recoup” (music industry lingo for return on investment); 2 - 3 may break even, 1 - 2 may return a profit, and 1 may become Drake or Taylor Swift.

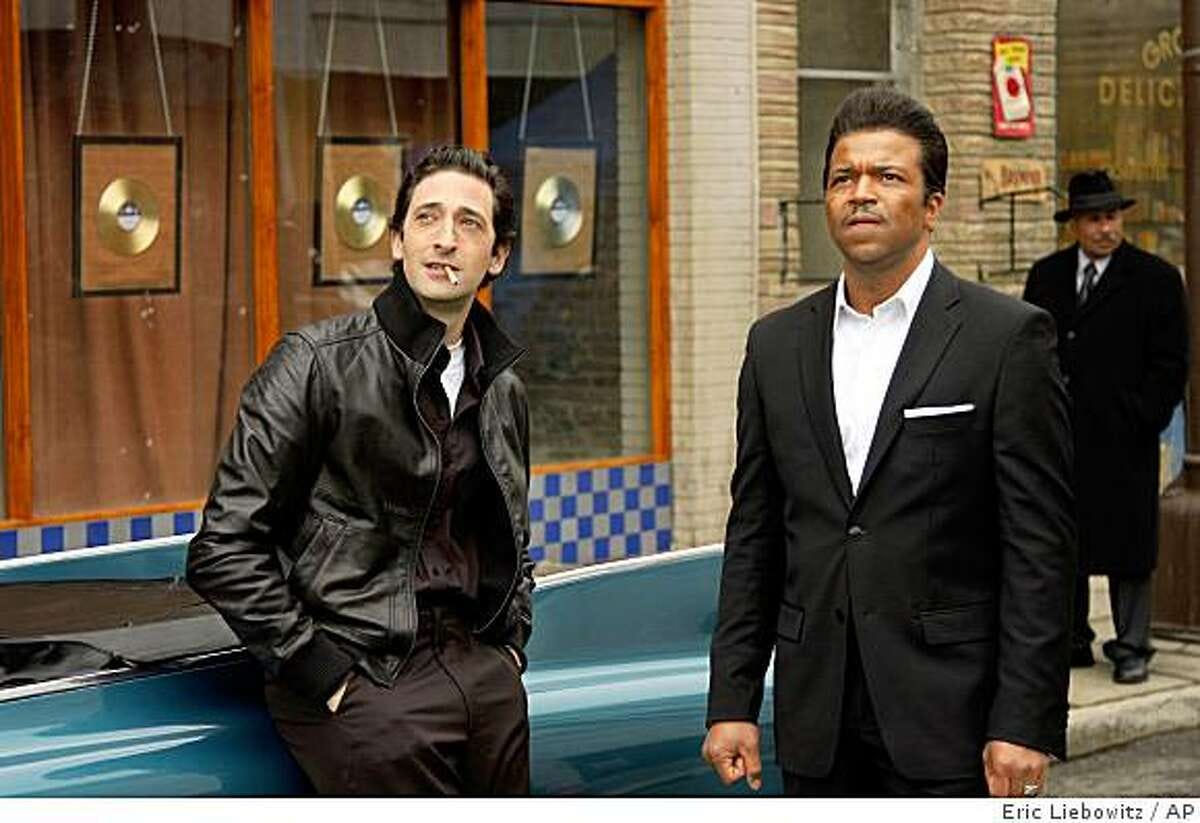

There’s a scene in the movie ‘Cadillac Records’ where an artist, Muddy Waters, asks his record label owner why he isn’t seeing the checks that he used to and why it seems like Chuck Berry, another artist, is the only one making money. The label owner says something to the effect of “Chuck is the only artist making money, and he’s paying for you and your car”.

In other words, 1 artist was subsidizing the cost of a whole roster of artists… that’s what power law distribution looks like in the music business.

This is the reason why superstar artists can get almost anything from a label.. it’s also why major sports leagues don’t mind paying gigantic amounts of money for their biggest stars. The salary athletes like Lebron, Steph, and Giannis receive is a fraction of the economic impact they have on their respective teams and cities.

It’s also why you often see the same entrepreneurs receive multiple investments.

The truth is, at our core, we humans can be very simple; and driven by only a handful of desires, levers and incentives. One of these is fear.

No one wants to lose money..

When people are fearful, they look for safety and comfort. What comforts most people is familiarity.

In business, familiarity can be expressed by one person conveying, to another, their past track record, results, and performance in such a way that it engenders confidence and comfort in the recipient.

But the word familiarity also comes from the word familia (or family), meaning someone who is related to you, looks like you, acts like you, talks like you..

A fancy name for this, in business, is “confirmation bias”.

So, in the business of record labels and venture capitalists - it’s not true that the best ideas, most competent founders, and talented artists get funded.

It’s not true that the smartest, and most skilled, executives rise up the ranks.

No, that’s not what it is at all.. you will lose if you think that.

Business is about money and family. That’s how the world’s system works. It’s always been that. On earth, you have to find a way to show someone you can make them money; otherwise you have to be a part of the family.

Sometimes it’s cool to be part of the family.. other times?

Outside of that, you better pray for divine guidance.

“I have seen something else under the sun: The race is not to the swift or the battle to the strong, nor does food come to the wise or wealth to the brilliant or favor to the learned; but time and chance happen to them all” (Ecclesiastes 9:11)

To close this out, it’s important for founders aka artists to understand the business and business incentives of the investors, financial institutions, labels, and venture capitalists with whom they may have to interact.

None of these players have been endowed with any divine quality you don’t have access to as a founder or artist. If you have the talent, grit, and vision to succeed as an artist or founder then you’re halfway there.

Money doesn’t create product.

Talent and vision creates product.

Money provides the incentives needed to galvanize labor and resources which, in turn, help scale product.

A dumb rich man can’t create s* by himself.

But an intelligent poor man can create a prototype, which can be validated, and later improved and scaled with money.

I’ll call this the Chief Keef Effect. Chief Keef is one of the most influential rappers of the younger generation. His big break came when a music video, recorded in his grandmother’s house, blew up on Youtube. The next thing you know, he had the biggest artists and labels in the world wanting to sign and work with him.

It’s at that point founders and artists have to be careful, because people with money like to make poor talent feel like they need them.. when it’s often the other way around.

Unfortunately, talent often drinks the kool aid..

I’ve seen it more times than I care to count.

It’s important for founders and artists to understand the business, because they’re often inclined to believe the hype. They see the announcements about record deals, term sheets, fundings; etc. and they think everyone is balling.. and they fall in love with the shiny things. When, in reality, most artists end up shelved or dropped, most venture backed companies don’t have large IPO’s or exits (if they exit at all); and most startup equity options end up being worthless.

Every young artist wants to be the next Lil Wayne, but they don’t know about the 45 year old who signed a bad record deal at 18, made the wrong decisions, lost everything, and is on Instagram still trying to make his rap dream a reality.

In the words of Venture Capitalist, Chamath Palihapitiya, it’s often one big ponzi scheme.

“Ain’t nobody cold as this. Do the rap and the track, triple double, no assists”

Kanye, Monster

Let’s talk about software engineers, producers, product designers, and songwriters; you know.. the one’s who actually make the stuff.

In the music business, producers and songwriters produce and write the songs that artists perform. Sometimes, the artist who performs the record also wrote and may have produced it; but, often, particularly for superstar artists - the song was already written and produced before the artists got a hold of it.

‘I Will Always Love You’ was written by Dolly Parton and popularized by Whitney Houston; ‘…Baby One More Time’ was written by Swedish songwriter, and producer, Max Martin then popularized by Britney Spears.

Fun Fact: he offered it to TLC first.

Many of your favorite songs, and classic records, weren’t written by the artists who made the songs famous. The artist simply brought it to life.

Likewise, in the tech field, the software code that powers many prominent companies, services, and products often isn’t created by the CEO’s or executives of the respective companies - instead it’s created by an army of software engineers and product designers. Often, the CEO or executive team are engineers or product designers who created an MVP (minimum viable product); but later hired engineers and product designers with expert level skillsets to further develop the product. Sometimes, in a founding team with multiple members - only one or two of the founders have technical skillsets; and other times, the initial founding team were technical experts who later relinquished their positions to bring on business people who could scale the company.

It just depends; but the point is, at a certain stage of a tech companies lifespan - the public-facing leaders of a company often aren’t the ones who build the product on a day to day basis - just as many superstar artists are simply the public face; but have a team of songwriters and producers, behind the scenes, who create the songs that fans love. This doesn’t mean non-technical founders or executives don’t have value; they just have a different kind of value.

This is another way the music business is similar to the tech field.

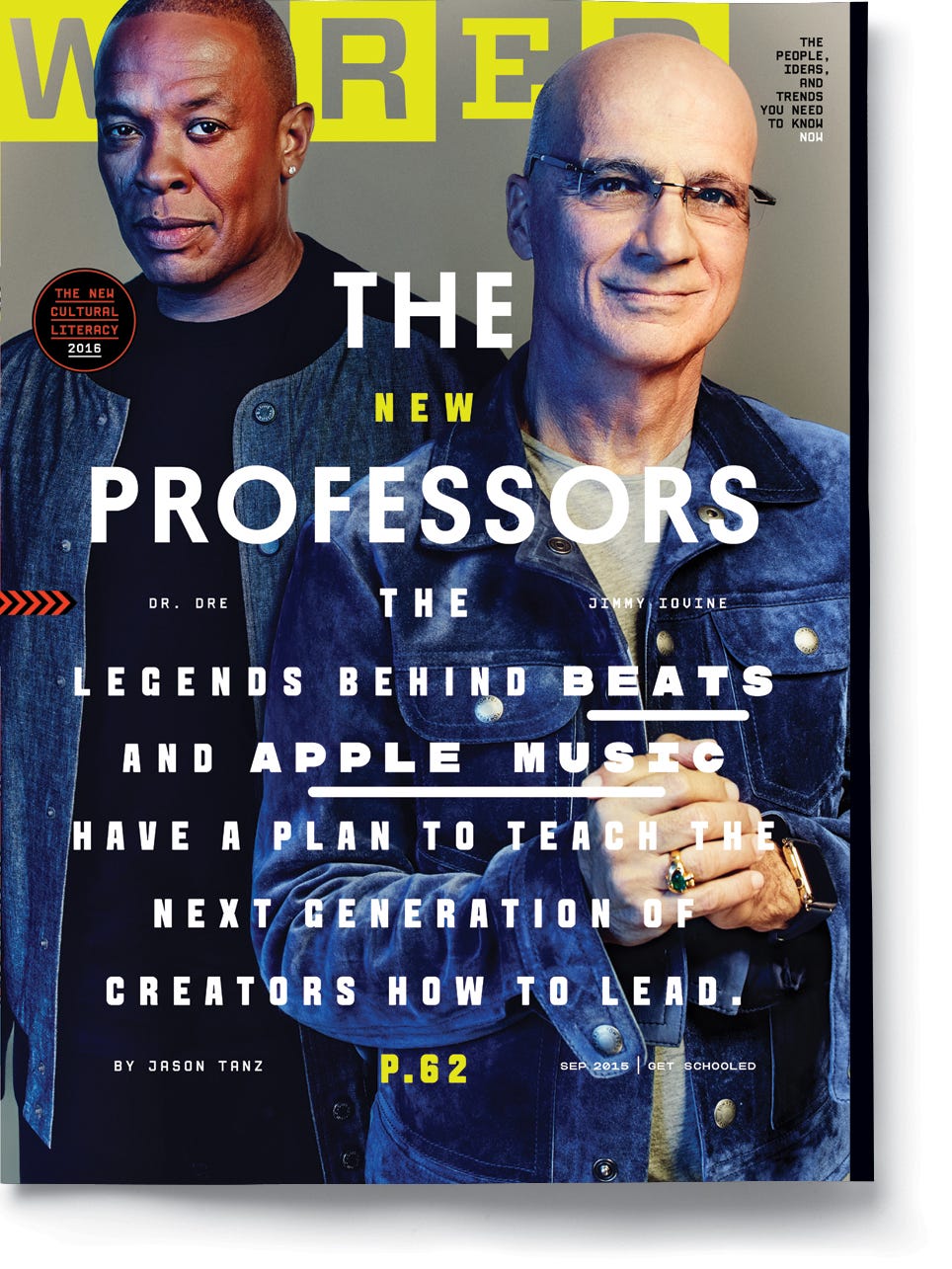

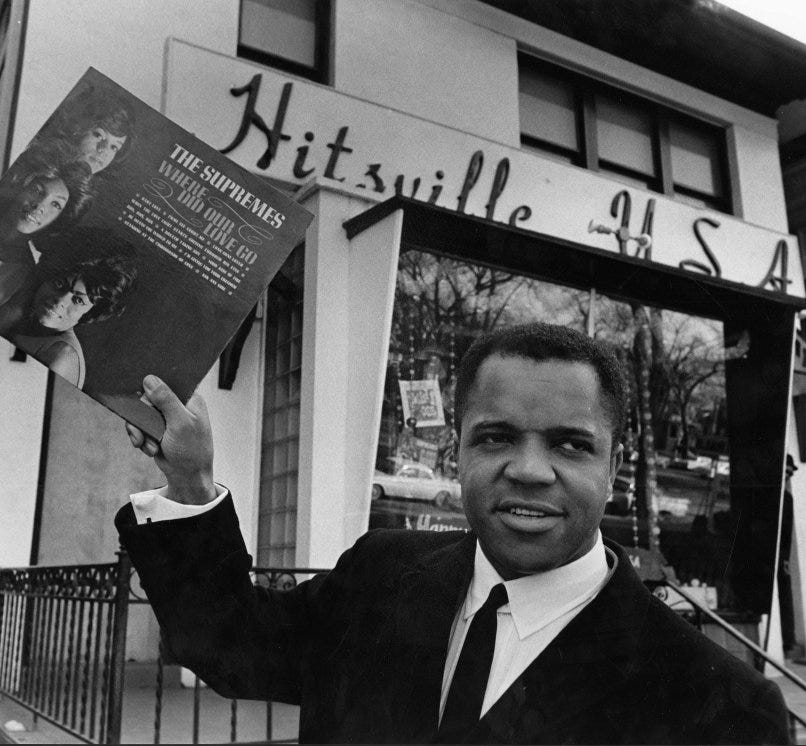

Personally, I’m fascinated by software engineers, product designers, music producers, and songwriters who go on to become founders and executives themselves. These are people like Satya Nadella (Microsoft), Bill Gates, (Microsoft), Ivan Zhao (Notion), Susan Wojcicki (YouTube), Jimmy Iovine (Interscope Records), Dr. Dre (Aftermath Records), Berry Gordy (Motown Records), L.A. Reid (LaFace Records); and many others.

Why am I fascinated by them?

Simply put, I believe that if you create something - you should own it.

I also appreciate the jump from talent to executive.

If you know how to make the product, understand how it works then you should lead the building of the enterprise which houses the product. If you know what the song should sound like, and what works for artists then you should probably run a record label or production company. Those who create and understand the product have a competitive advantage over those who have no domain expertise in that field.

The only thing you may be missing is the money to fund the business, and the executive skill set to profitably manage operations; but once you figure out that piece, you’re set.

As a music attorney, I always advised producers and songwriters to start their own labels and produce and distribute their own albums rather than solely chasing big names. My thinking is that instead of spending all your time chasing a placement where you’ll only receive a minority percentage of sound recording royalties, no ownership; and have to split ownership of publishing - why not be your own company where you’ll receive the lion’s share? Many big producers do do this; but you see it less with the up and coming producers; even less so among songwriters.

The opportunity is significant because just as a software engineer and product designer architect and built the code that powers software services and products, music producers and songwriters architect and build the songs that powers the careers of artists. However, if you aren’t the owner or investor in the company then your upside is lower and you may not see the big pay days that come from building and selling a record or publishing company.

This was something Berry Gordy, founder of Motown records (The Temptations, The Supremes, Stevie Wonder, The Jackson Five, Marvin Gaye, Smokey Robinson; etc.), keyed on. Berry was a songwriter who decided to start his own record label, and ended up selling it for ~ $61 million.. in 1988. He also sold Motown’s publishing catalog, over time, for ~ $322 million. Ownership is important.

“Most artists don't live as good as the execs; and they end up depressed. Scarred by A&Rs, the music be changin'; and the culture be shiftin', so you gotta move with it. Call me the party crasher, that plan spoiler”

Nas, Ghetto Reporter

See, in the music business, and outside of the record label and record executives, unless you’re a highly prolific producer and songwriter - the artist benefits the most. Artists benefit from tours, endorsements, and merchandise - income streams typically unavailable to producers and songwriters.. because they’re behind the scenes.

Logically, this makes sense because the artist is the show.. that’s why it’s called show business.

The artist is a production, a construct. Artists have producers, writers, brand managers, creative directors, touring companies, agents etc.. similar to ‘Cats’ on Broadway, ‘Hamilton’, or ‘The Avengers’ movies. When a fan goes to see Britney Spears, they’re not going to see Britney Jean Spears. They’re going to see Britney Spears the production.

This is one of the reasons many artists experience mental health problems. There’s often a severe disconnect between their private lives and their manufactured public persona.. but that’s a different story.

The point is, in the music business, the labor and rewards are stratified in ways that can create discontent in the minds of those who are often doing most of the work to create the songs. It’s why Berry Gordy was able to sell Motown for $60m, it’s why record label executives make money, and it’s why many creatives end up broke and disillusioned.

The record label and record executives are the ones operating the business; the artist, producer, and songwriters often only care about the show.

Know the business.

To bring this down to earth, I do believe everyone has their own skillset and area(s) of expertise and strength. We won’t all be founders of unicorn companies or executives of hundred million dollar record labels; but you don’t have to be.. those aren’t the only options. You don’t have to be Mark Zuckerberg or Jeff Bezos in order to consider yourself a successful founder. As we’ve seen, most venture backed companies fail; most business, in general, fail.. but there are other ways you can leverage your talent, and experience, and manifest your destiny.

This is a truth that startups like MicroAcquire, Start Engine, Kick Starter, and Go Fund Me, have keyed on - they provide alternative financing opportunities for founders who aren’t necessarily looking for venture capital; but still want to raise funds to fulfill their vision(s). In the same way, we’re seeing alternative financing companies in the music business like Beat Bread and The Music Fund that provide options for artists, songwriters, and producers who may not want to go the traditional route.

For producers, writers, engineers, and product designers - the challenge is to acquire an executive mindset and skillset then combine that with your domain expertise. If you can successfully do that then you’re virtually unstoppable.

In Closing

At the end of the day, we’re seeing a mass questioning and rethinking of the traditional venture capital, and recorded music industry, approach to investing in founders and artists. At the same time we’re seeing a rise of social media personalities and creators who have amassed large scale communities, coupled with direct access to their audiences, leverage their influence to build enterprises around their brands.

We’re also seeing artisanal founders like Jay Z and Nas enter the venture capital space. I believe these trends will continue. To be sure, not everyone and everything will succeed.. remember power law? But this trend isn’t going anywhere. And those who can continue to build bridges between the old and new school will be the leaders of tomorrow.. particularly when it comes to the intersection of media and tech.

Elijah Adefope is a media, entertainment, and technology consultant and attorney. He is Lead Counsel at Substack, a media technology platform for creatives, and has written two books on the music and sports industries. He lives in Atlanta, Georgia and can be reached on LinkedIn or at elijah@thrivesportsent.com